05 Sep Freight Management sees stronger 2016

After a subdued 2015, it is targeting up to 15% growth in earnings next year

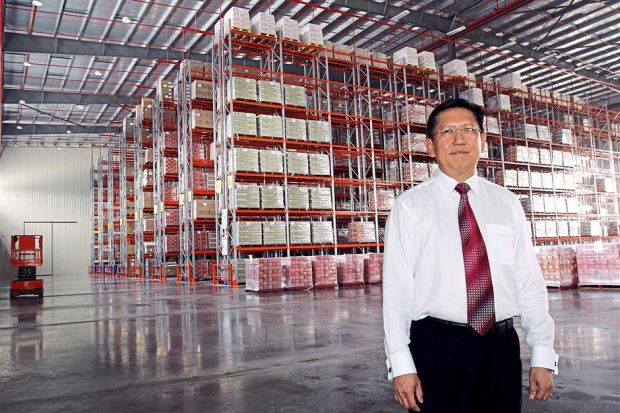

LOGISTICS and freight service provider Freight Management Holdings Bhd (FMH) hopes to be able to resume its growth trajectory in the financial year 2016 (FY16) ending June 30,after a somewhat subdued FY15.Managing director Chew Chong Keat tells StarBizWeek that FY15 earnings will be subdued due to some necessary long-term investments that had to be made in the year for the betterment of the company, moving forward.

For the third quarter in the year-to-date (YTD) period that has been announced, we reported lower earnings from the corresponding period in the previous year. In the fourth quarter, full-year earnings will also be lower, in line with what had been seen in the third quarter,Chew says.

Other than a challenging macro outlook, we also did a reorganisation in our air freight business in FY15. And in our third-party logistics services, our new warehouse was completed in the second quarter that incurs depreciation, set up and interest charges. All these affected our profit,he adds.

In the YTD period until its third quarter, FMH’s earnings had declined 13.76% to RM13.66mil despite revenue that rose 4.26% to RM312.17mil.

The trade outlook has been quite negative and moving forward it will be a challenging outlook for us and the major logistics players. We would be worse off, say, if we were situated in Europe, where logistics players there are facing very severe challenges, he says

A little hiccup in its performance for FY15 should be seen in the larger context as longterm shareholders would be pleased that FMH had consistently registered an earnings growth in the past 12 years since FY03.This growth translates into a compounded annual growth rate of 15.1% from FY03 to FY14.

Moving ahead, Chew says the company hopes to see better times ahead and is targeting to achieve up to 15% growth in earnings in FY16

This is what we have achieved historically if you track our performance over the past 10 years. In FY16, we are looking at a more positive outlook notwithstanding a continued challenging environment. FY15 would be the only time we have not shown growth since our listing,” Chew says

In FY15, FMH had made a RM30mil investment for its warehouse that will give it additional exposure into the high-growth industries of the pharmaceutical and healthcare sector

adding that capex requirements for FY16 are expected to normalise.FMH found it necessary to invest in this segment, given that the pharmaceutical and healthcare business had seen a strong growth in FY14The RM30mil is on top of the yearly capital expenditures (capex) of about RM10milRM15mil in FY15. The new warehouse allows temperature control and a higher value business. Due to pharmaceutical requirements, the environment has to be controlled,”chew says

The growth was from practically nothing to occupying 70,000 sq ft for temperature controlled warehouse storage space. Other than that, we are also seeing the food and beverage clients that are fairly new to us,” he says.

Moving forward, Chew says he expects FMH’s core business segment of seafreight to continue to drive its overall business forward.

Seafreight volume is still growing with some segments at double digits and can grow further, moving forward. In the shorter term, the challenges for our customers is in terms of import due to the very weak ringgit but in terms of exports, I see a lot of our customers are experiencing a spike in volumes,” he says.

FMH is not directly involved in the transportation of exported and imported goods but rather the company hires third-party shipping lines to transport goods while it resells these services with its own value-added services.

“These shipping line companies are our vendors, thus we are not exposed to the overcapacity challenges that are happening among shippers. We are also not exposed to the fluctuations in oil prices as we adopt a cost-push approach that will see our customers benefiting should rates drop as well,” Chew says.

The company specialises in transporting less than a container load (LCL) for customers which Chew says is a niche business.

“We are probably the only listed company that sees freight being our core business. Some other similar companies may be strong in third-party logistics, warehousing or even the last mile delivery,” he says.

Other than its core business, Chew also hopes to tap growth within the e-commerce space with its 20% investment in Hubwire Sdn Bhd.

According to a research by AT Kearney, less than 1% of total retail sales are made online in Malaysia in 2014 as opposed to around 4%-5% in Singapore. We see a lot of growth potential in this area

“Many of our customers that we talk to already have a traditional source through retailing or distributing, for example, but I think a lot of them are thinking of e-commerce as they also want to sell online. We would now be able to provide these solutions for them,” he adds